National Best

Term Life Insurance

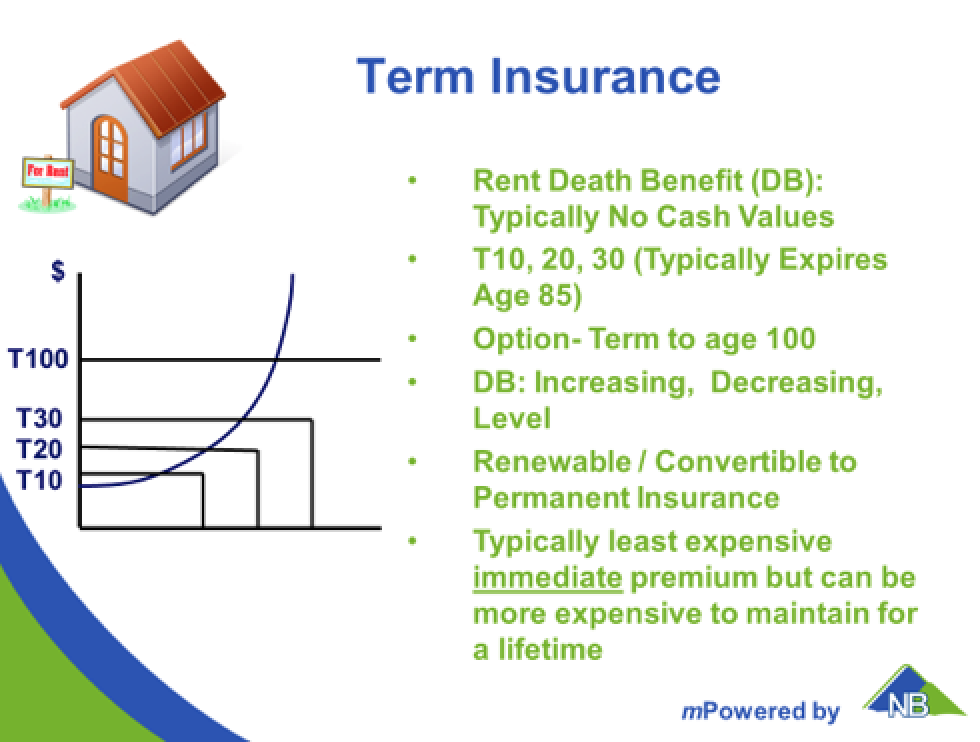

Term Insurance is like renting a house, or in this case, renting a death benefit. You can fix the cost of rent for 10, 20 or 30 years (T10, T20 or T30) or even to age 100. At the end of the term, the price increases, often significantly. If you are alive at the end of the term and you choose not to renew your policy, or the policy expires (typically age 85), you don’t get any cash back from your policy (just like if you move out of a rental after 10 years) – you don’t have an asset.

Term insurance can be used to address some of your needs from the 5 Finger Rule. It is particularly good for temporary purposes or for insurance coverage that only needs to be in place for a specific time period. Although it does automatically renew without any medical evidence, it becomes much too expensive and later years for most people to keep it. Many companies allowed term insurance to be converted to permanent insurance. This is a very valuable option should an annuitant ever become sick with a terminal illness or become uninsurable just before a renewal date.

If someone is trying to convince you that term insurance is the only kind of life insurance that is valuable, they are wrong. Each type of life insurance, whether it be temporary or permanent, has extremely valuable benefits that cannot be reproduced easily. We will go over those benefits when we talk about Whole Life Insurance and Universal Life Insurance

Get In Touch

Head Office:

Unit#: 67B, 4511 Glenmore Trail SE,

Calgary, AB T3C 2R9

Phone: (403) 590-4500

Toll-Free: 1 800 503-6140

Fax: 1 877 904-7715